The whole concept of modern insurance is non-conventional. A few rich guys in a bar in London agreeing to pool their money and the risk of loss to their ships. As well as cargo due to piracy, storms and other catastrophe. Amazing!

What about insuring less conventional assets? If you have a large or fast boat, ATV, RV or Trailer, short-term rental property or investment property under construction you may have inadequate insurance. Today, the most common types of insurance for your car, home, health, life, or disability, usually do not provide the most comprehensive coverage for unique needs. So, how do you insure those less conventional assets, with InterWeb that’s how!

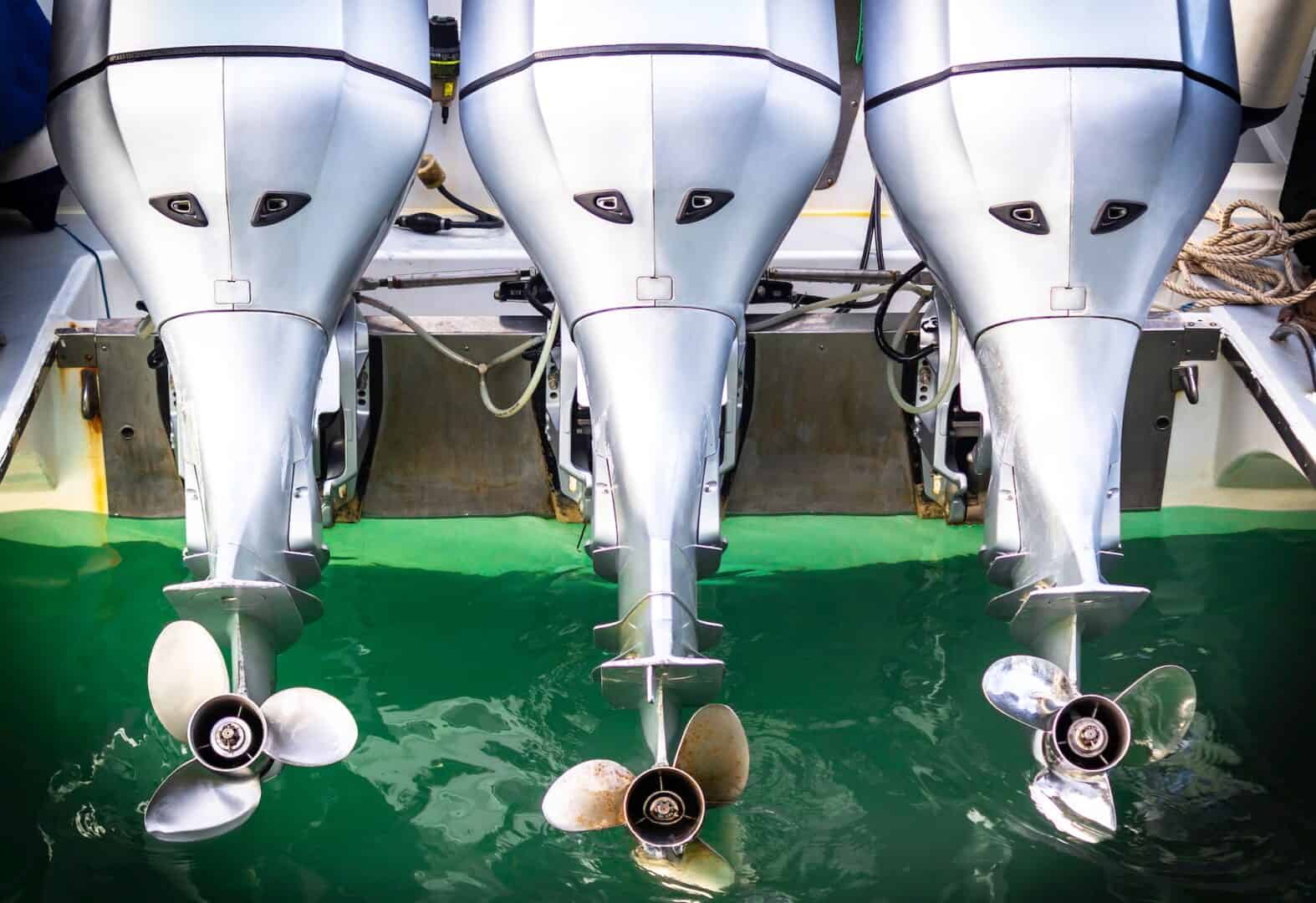

Boats and Watercrafts

Owning a sailboat, motorboat, or any other personal watercraft comes with the risk. Such as theft, damage, or accidents. Boat insurance offers cover for you, your vessel, or any other parties, be they individuals or property. The policy typically covers different parts of your vessel. Including the hull, fittings, furnishings, machinery, or any other attached equipment. Since coverage needs vary from individual to individual, its always best practice to talk with an agent for a more personalized coverage plan.

Generally, boat insurance is divided into two basic types – agreed value and actual cash value. What sets them apart is how depreciation is handled. With an agreed value policy, you get cover for your vessel based on its value at the time the policy was drafted. Yes, it typically costs more upfront. But there’s no depreciation for a complete loss of the boat. An actual cash value policy is cheaper upfront but factors in depreciation. Therefore, this policy only pays up to the cash value of the boat at the time it’s declared a partial or complete loss. Being located in Lake Havasu City, InterWeb knows boaters, and we understand how important your ride is to you. That’s why our coverages are designed by people who know about cruising the open water. Also, why our claims are handled by adjusters who deal specifically with watercraft.

Off-Road Vehicles

Off-road vehicles, incorporate a wide list of vehicles including dirt bikes, all-terrain vehicles (ATVs), snowmobiles, dune buggies, or golf carts. An off-road vehicle insurance policy covers both you and your vehicle against any mishaps while out on the trails. The most common types of coverage include property damage liability, bodily injury liability, collision coverage, and comprehensive coverage.

Property damage liability covers any repairs to someone’s property. In case of damage by your off-road vehicles. Bodily injury liability offers cover for someone’s medical bills if you’re found liable for the accident that led to their injury. Collision coverage covers the cost of repairing any damage your vehicle suffers from a collision. Comprehensive coverage covers damage caused by circumstances outside collision, for example, hail or theft. When getting a policy, always get information on your coverage limits, deductibles, and if possible, discounts. InterWeb understands how important your adventures are to you. Thus, you don’t want to risk your personal assets by being under-insured. That’s why our coverages are customized with you in mind. Our claims are handled by a best-in-class claims staff. We know off-road vehicles and the people who ride them, because you and your adventures deserve it.

Short-Term Rental Investments and Vacation Homes

While you may not use it as often, a vacation home or an investment property rented briefly to vacationers still need proper insurance cover. Because you don’t occupy it as often as your primary home, these properties are at a greater risk for instances. Such as vandalism, theft, or undetected damage such as burst water pipes. Various factors are likely to impact how much you pay for your policy.

Firstly, there’s the type of property you own. Expect a condominium within a ski-resort area to cost less than a stand-alone single occupancy house thanks to the homeowners association factor. HOAs maintain the property and often provide security. Secondly, there’s the location of your vacation home. A beach-front home is likely to cost more to insure courtesy of wind exposure or the potential threat of a hurricane. Lastly are your home’s amenities. Additions such as hot tubs, pools, or even an extra home office push up premiums. Owing to a higher probability of damage or greater maintenance costs. InterWeb insures all kinds of vacant homes, including homes for sale, homes for rent, vacant manufactured homes, and homes in the name of an estate or an LLC.

Whether you’re insuring your boat, off-road vehicle, or vacation home, remember that your homeowners’ insurance policy doesn’t typically cover insuring less conventional assets. As such, always strive to secure yourself and your assets through relevant insurance plans. Remember, the nature of risk lies in its volatility, so never allow sudden circumstances to blindside you. With the right insurance policies, they never will. Have a question? Give us a call today (866) 277-7162